Flutterwave is an online payment gateway that provides merchants and banks to accept, manage and process digital payments through a seamless and secure payment solution. With Flutterwave, a merchant can accept local and international payments from card and bank accounts. This innovation also powers services like PiggybankNG, Thrivesed.com, Wallet.ng, MAXGO and a host of other online platforms.

When was Flutterwave founded, it’s location and who owns Flutterwave?

Flutterwave was founded in 2016 by a team of ex-bankers, entrepreneurs and engineers with the goal of providing a reliable and intelligent payment gateway for online businesses all around the world.

Flutterwave founder, Iyin Aboyeji and Olugbenga Agboola are the founders of Flutterwave. Last year, Aboyeji left his role as CEO of Flutterwave, a position he held for two years which is since the payment solution startup began. Fellow co-founder, Olugbenga Agboola has taken over his role as CEO.

Flutterwave Headquarter is located in San Francisco with branch offices in Lagos, Nairobi, Accra, and Johannesburg.

Is Flutterwave secure and safe?

Yes! Flutterwave is PCI DSS (Payment Card Industry Security Standards Council) certified. PCI DSS is an independent body created by major payment brands (Visa, MasterCard, American Express, Discover and JCB) designed to ensure all companies that accept, process, store or transmit credit card information maintain a secure environment.

Flutterwave Products

Flutterwave is the parent company housing two major products:

- Rave

- Barter

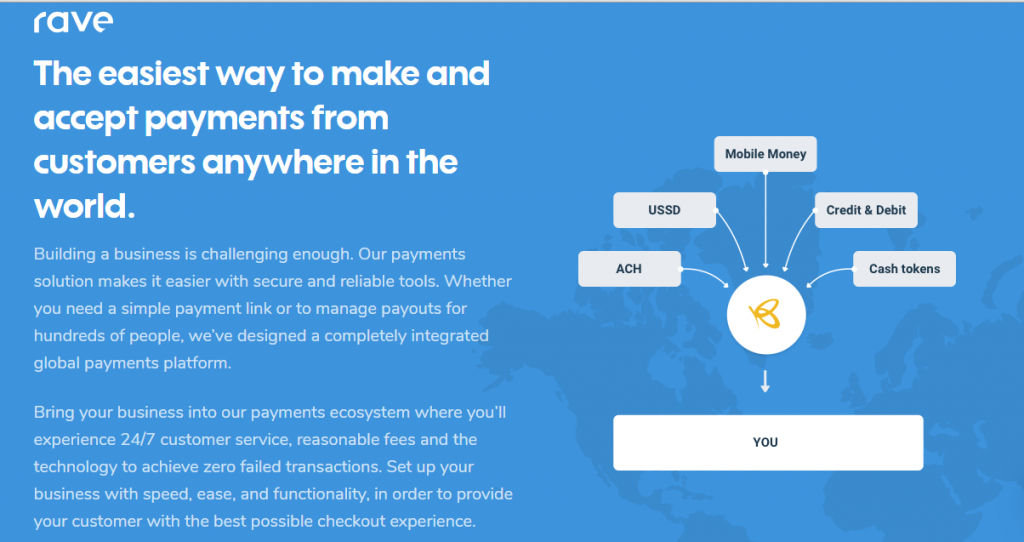

Rave

Rave is a product from Flutterwave which provides merchants with the ability to receive worldwide via card, bank accounts, and USSD [powered by mCASH]. Since rave was launched, it has been integrated into several online websites and apps. Merchant can receive payment from customers in 154+ countries supporting Visa, MasterCard, Verve. Companies using ravepay as a payment solution for their business are Uber, Jumia, Flywire, Bookings, Arik air, etc.

If you are a merchant and want to start using Rave from Flutterwave, visit ravepay.co

It’s free to register with no hassles and zero setup fees

- Local Payment method: MasterCard, Visa, Bank Account, USSD

- 1.4% Processing fee (local)

- International Payments method: MasterCard, Visa, American Express

- 3.5% Processing fee (international)

Pros of Rave

- Easy integration with popular CMS like WordPress, Joomla, Prestashop, Magento, Shopify, OpenCart, etc.

- Easy integration Mobile apps

- No setup or monthly fee

- Top-notch security

- Multicurrency support

- Ability to white-label your service to customers

Cons of Rave

- No support for Pounds and Euros

Barter

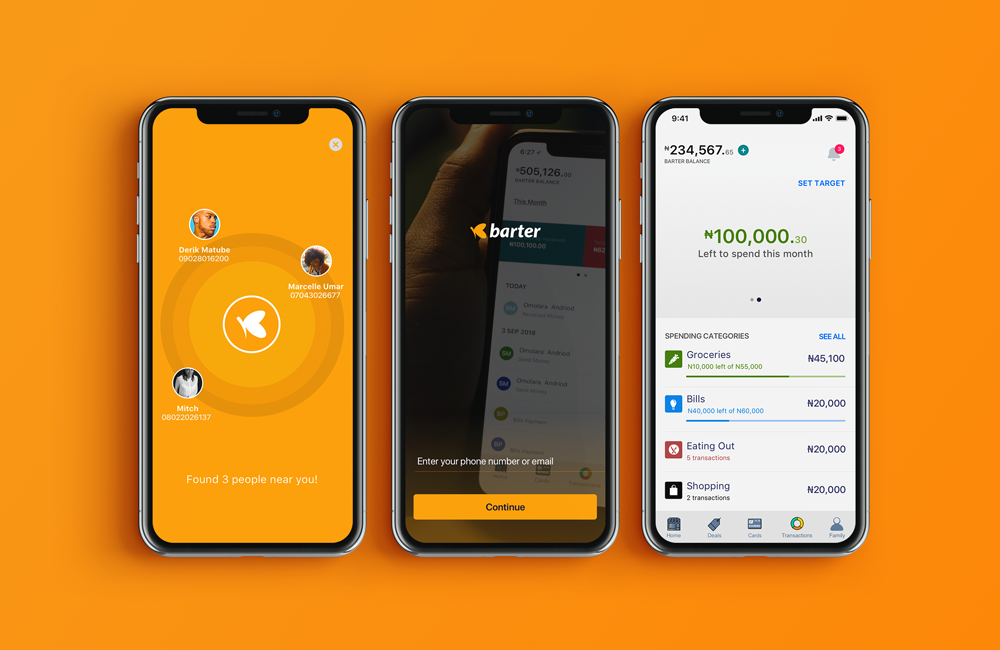

Barter (formerly called Getbarter) is another amazing product from Flutterwave. I started using it when it was just a web app and it been saving lives since the ’80s (lolz).

Barter is meant to assist users to make their lives more enjoyable and to invest, give and lend cash less.

Barter is available for Android and iOS mobile device. With the mobile app, you can send money to friends near you and set smart reminders. That’s not the main feature of barter because the majority of users make use of the mobile app to generate virtual credit card to make an online transaction on platforms like Netflix, Apple Music, Web hosting and domains, E-commerce and many more. You can generate a naira or a dollar MasterCard depending on what you want to what currency is supported by the vendor.

Other features for barter is to settle household billings like a utility bill, Electricity bills, Data and recharge card plans, etc.

Pros of Barter

- The ability to generate naira and dollar virtual card is great.

- Get detailed reports that show your spending patterns and insights.

- Ability to pay for local billings

Cons of Barter

- Cant generate virtual card in Pounds and Euros.

Flutterwave Funding Rounds

According to CrunchBase, a total of $20.4 million in funding over 9 rounds has been raised by Flutterwave. Its most recent funding came from a Series A round on 15 October 2018. The most recent investors are Raba and MasterCard.

| Transaction Name | Number of Investors | Money Raised | Lead Investors | |

| Oct 15, 2018 | Series A – Flutterwave | 5 | $10M | — |

| Jul 31, 2017 | Series A – Flutterwave | 7 | $10M | Green Visor Capital, Greycroft |

| May 23, 2017 | Non Equity Assistance – Flutterwave | 1 | $50K | Google Launchpad Accelerator |

| Apr 5, 2017 | Series A – Flutterwave | 1 | $250K | — |

| Aug 15, 2016 | Seed Round – Flutterwave | 1 | — | — |

| Aug 15, 2016 | Seed Round – Flutterwave | 10 | — | Y Combinator |

| Jun 12, 2016 | Pre Seed Round – Flutterwave | 1 | — | — |

| May 13, 2016 | Angel Round – Flutterwave | 1 | — | — |

| May 12, 2016 | Seed Round – Flutterwave | 3 | $50K | — |

If you have any question, please leave a comment below.

i have use flutterwave and it really serve my purpose.. i believe flutterwave will soon become giant company in nigeria tech company